How we make it happen

1.Acquire

Profitable businesses. Founders who want to win. IPO ($NPKN) by 2027 📈

STOCK & GROWTH CASH

We acquire using cash & Napkin shares. We bring in cash to grow. All staff get employee stock option plans.

2.Optimize

Cross-sell together.

Win deals and lower OPEX.

Cash is

POSITIVE CASH FLOW

High revenue and profitability is what we want. The bankers love us for this. You’ll thank us later.

Founders build product.

Napkin keeps acquiring.

Share price goes 🚀

$10+ PER SHARE AT EXIT

We look for the best builders on the planet. Digital disruption is key for a juicy Napkin valuation at IPO.

Secret SauceThe founders.

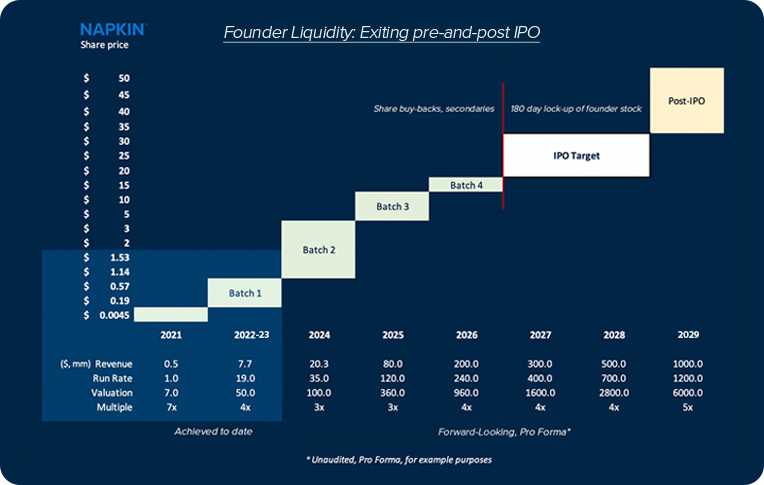

- Founder Batches Napkin groups multiple founders’ revenues together and conducts batches of acquisitions simultaneously. This ensures guaranteed growth, diversified risk for all, and transparency across our shareholder ecosystem.

- Founder Strength We are a group of elite founders. We provide strength to founder‘s operations, finances and back-office. We don’t come in and uproot people and systems — we honor and empower each other synergistically.

- Founder Liquidity Napkin plans to IPO after completing four batches with a valuation surpassing $1bn. Pre-IPO liquidity options include share buy-backs and secondaries. The IPO is targeted for high-volume markets like TSX and NASDAQ,

Acquiring process: Powered by AAA’s

1. APIs

Get lightning-fast due diligence done, with API scans of sales info

and accounting portals.

2. AIs

AI helps us batch financials together with other acquisitions to see the shareholder value we can create.

3. Algos

Algorithms provide a synthesized and trusted data source to get fast board approvals on acquisitions.

+

Good

people.

We work tirelessly to make acquisitions incredibly simple. So you can keep on going. And going. And going…

Friends with benefits

As our network grows, so does the advantages.

- Global Networking

- Access Growth Capital

- C-Level Training

- Enterprise Clients

- Award-Winning Talent

- Fortune 500 Portfolio

- Culture of Winners

- Large Catalogue

- Passion-Focused

- Management Retreats

- Administrative Support

- Elite Advisory

- Major Conferences

- Friendships for Life

- Achieve Larger Exit

“It’s all about giving and

receiving.” — Anonymous (you know who you are)

Let’s Make A Napkin Deal.

Plug in some high-level info to see what you could qualify for.

Yes, we’re global.

The best talent and companies on earth are being acquired by Napkin 🙌 .

$1 Billion+

Minimum Target

Market Cap at IPO

$250 Million+

Current Pipeline

of Acquired Revenue

350+ Staff

Employed by Napkin

Companies

Napkin Canada

Napkin Canada Napkin USA

Napkin USA Napkin India

Napkin India Napkin UAE

Napkin UAE Napkin Ecuador

Napkin Ecuador

And many more to come…

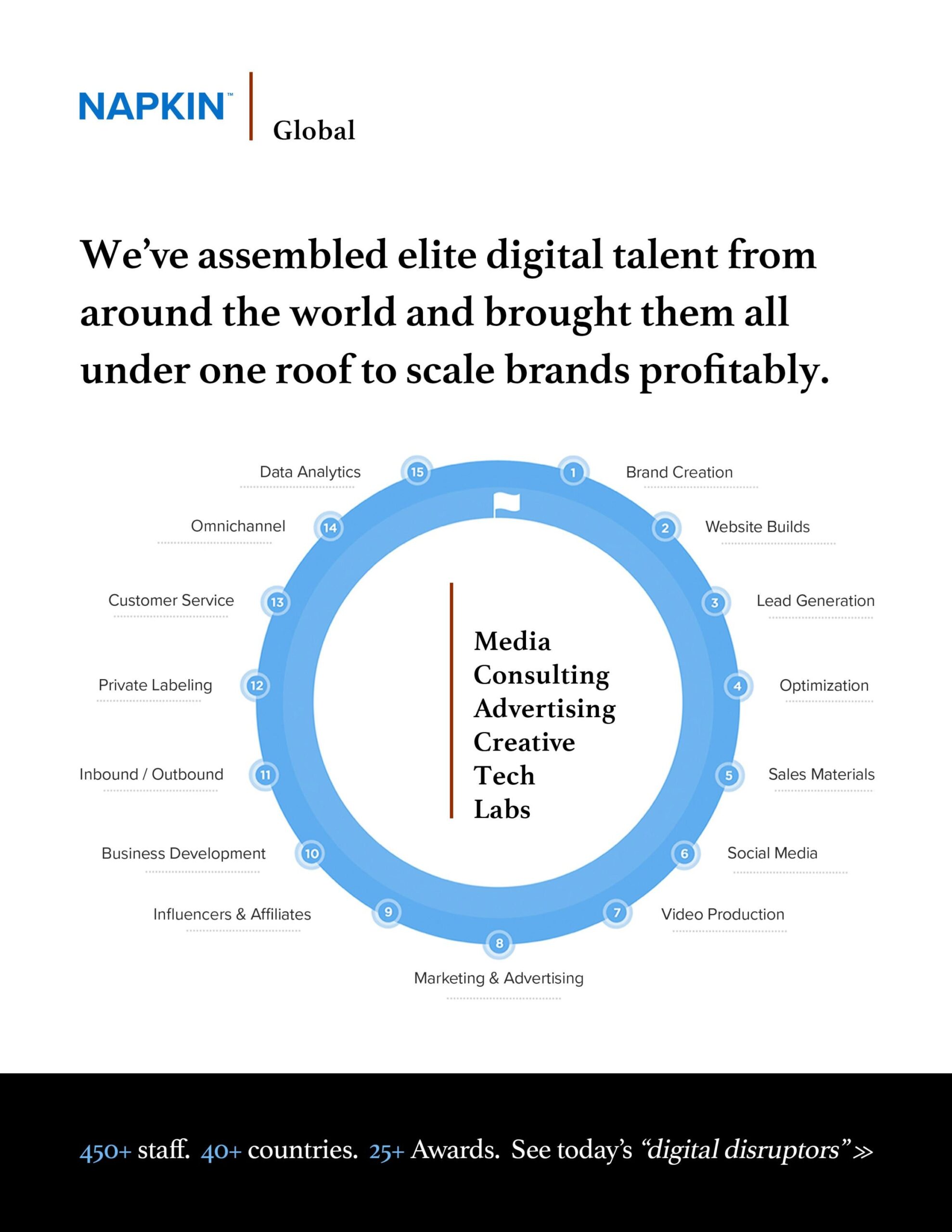

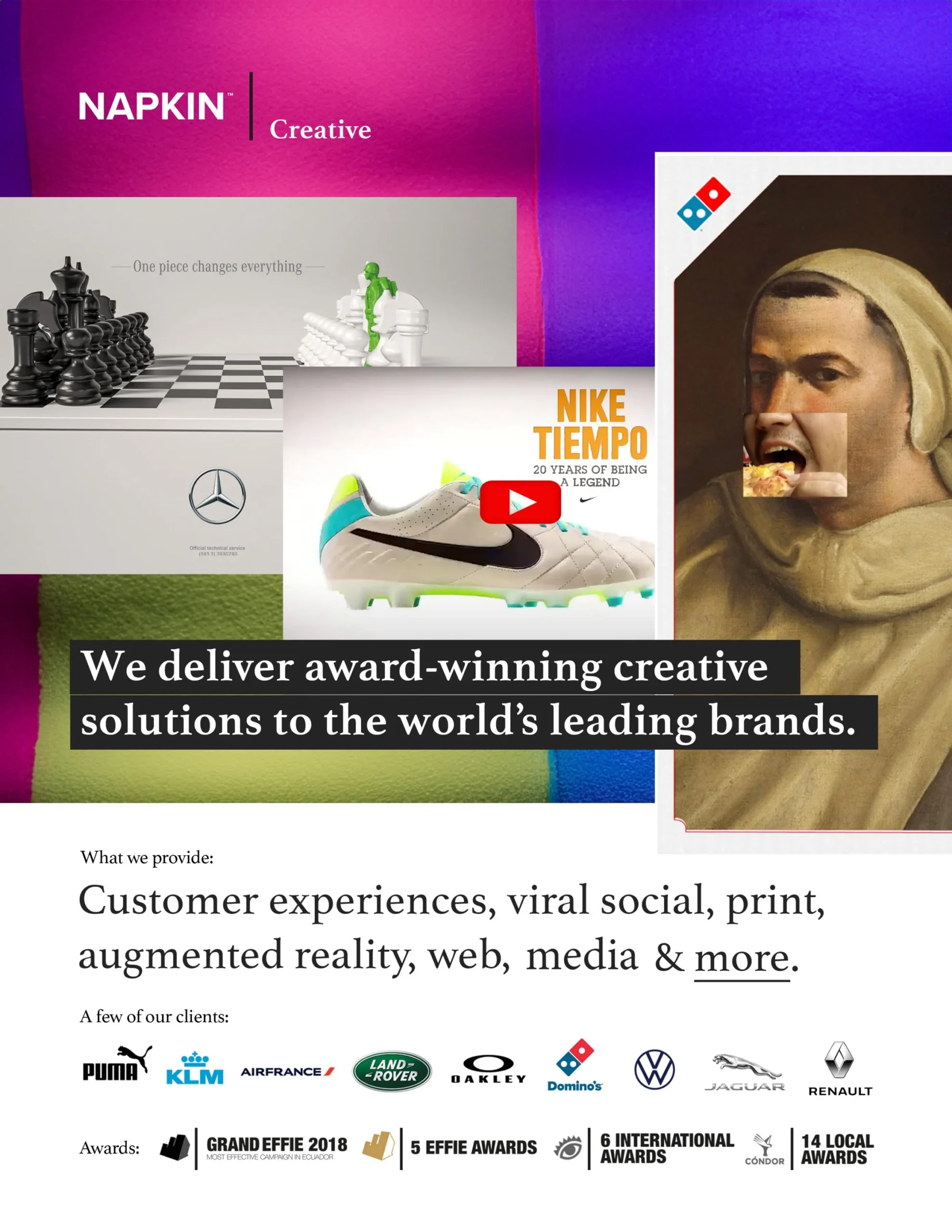

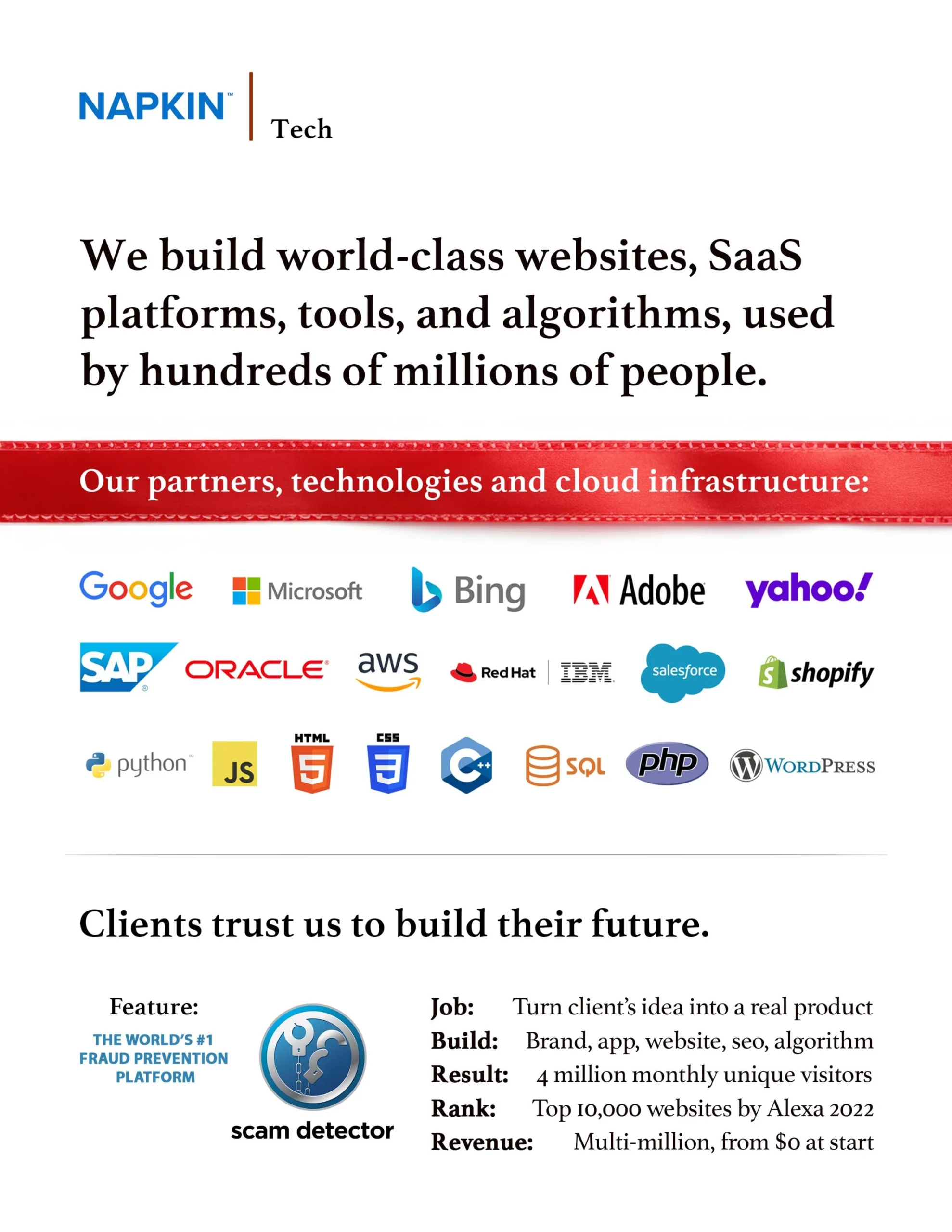

Elite digital talent

Take a look inside what Napkin has to offer. No srsly.

Industry Leaders Coming Together as Napkin.

Our team mean the 🌎 to us. What do they think about Napkin?

“To be part of Napkin is to live under the maxims of respect for the identity of companies and constant search for integration between enterprises. That is why we live in a day-to-day growth where entrepreneurs from various countries put the best of their abilities to be better together.”

Martha Concayo

Napkin LATAM CEO

“Joining Napkin Inc. as their accountant from the very beginning is a dream come true. It’s an honor to be part of this incredible journey, ensuring financial clarity and growth for a company I deeply admire. Together, we will build a legacy of success and innovation.”

Suzana Seis-Manto

Corporale Controller

Know someone who’d be a good fit? We’ll pay for leads that turn into Napkin deals.

Built by Entrepreneurs, who love Entrepreneurs

“We’re two best friends and entrepreneurs that love travelling the world and trying to change people’s lives. From fair trade cocoa exporting in Africa to software developing in India — we found people are people, everywhere. They usually just want a hand up, not a hand out. So we said, ‘let’s make a way to give it to them!'”

Meet the Founders, Grant Anderson & Matthew Liberto

Our Brands are in the news: